Rather, under GAAP accounting, it should be gradually and systematically amortized over the term of the agreement. Under the cash basis an organization would immediately record the full amount of the purchase of a good or service to the income statement as soon as the cash is paid. Prepaid expenses, or Prepaid Assets as they are commonly referred to in general accounting, are recognized on the balance sheet as an asset.

Benefits of Prepaid Insurance

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. The matching convention requires allocation of the expenditure between the asset that represents the remaining economic benefits and the expense that represents the benefits used or consumed by the firm. However, the rights to these future benefits or services rarely last more than two or three years. This blog covers the ins and outs of prepaid insurance, its importance, advantages, examples, ways of recording, calculations, and much more.

Do you own a business?

This reflects its short-term nature and its expected use within the current accounting cycle. This article dives into the world of prepaid insurance, answering your frequently asked questions and clearing up any doubts. Prepaid insurance can be a confusing term, especially when it comes to accounting. Get granular visibility into your accounting process to take full control all the way from transaction recording to financial reporting. When insurance is due for each quarter, i.e., $2,000 will be subtracted from the prepaid account and is shown as an expense in the income statement for that reporting quarter. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Lease Commencement Date and Start Date for US GAAP Accounting Explained

It is considered a prepaid asset, which is a way to express these benefits in accounting terms. In the business, the company usually needs to make an advance payment for the insurance that it has purchases. In this case, it is important for the company to record the payment as prepaid insurance. Common examples of prepaid expenses include leases, rent, legal retainers, advertising costs, estimated taxes, insurance, salaries, and leased office equipment. To estimate the amount of a prepaid asset’s monthly benefit, divide the total cost of the asset by the number of months of benefits the asset represents.

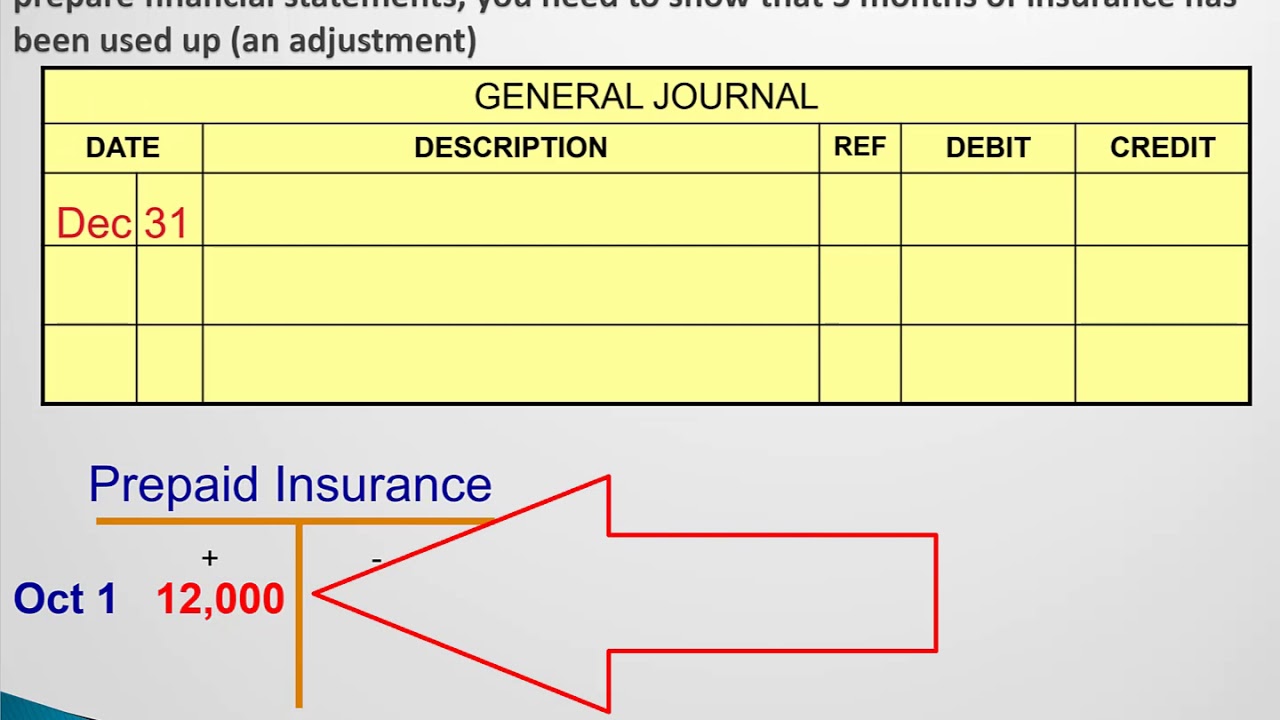

Adjustment entry for Prepaid Expenses

In this journal entry, the company records the prepaid insurance as an asset since it is an advance payment which the company has not incurred the expense yet. This means the company should record the insurance expense at the period end adjusting entry when a portion of prepaid insurance has expired. The accounting process for booking prepaid expenses is to initially record the payment as an asset and then gradually reduce that balance over time as the goods or services are used. Passing adjustment entries to balance the books of accounts is often helpful, preventing one from making an entry for new business transactions. To pass an adjustment entry, one must debit the actual expense and credit the prepaid expense account throughout the amortization. This prepaid account will come to the NIL balance at the end of the accounting period and all the expenses accrued in the income statement.

- From a financial accounting perspective, prepaid insurance is considered a prepayment.

- On July 1, the company receives a premium refund of $120 from the insurance company.

- To estimate the amount of a prepaid asset’s monthly benefit, divide the total cost of the asset by the number of months of benefits the asset represents.

- Delivered as SaaS, our solutions seamlessly integrate bi-directionally with multiple systems including ERPs, HR, CRM, Payroll, and banks.

- Recording prepaid expenses must be done correctly and according to accounting standards.

Do you already work with a financial advisor?

A prepaid asset is a type of asset that has economic value to the business because of its future benefit. For example, on December 18, 2020, the company ABC make an advance payment of $6,000 for the fire insurance that it purchase to cover the whole year of 2021. At the end of the year, there may be expenses whose benefits have been received but not paid for and expenses that may have been paid, but their benefit will appear in the next financial year. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

The adjusting entry decreases the asset account and records an expense for the amount of benefits that have been used or have expired. The balance of $1,500 in the Prepaid Insurance account represents the future benefits of the insurance policy, and the $900 balance in the Insurance Expense account represents the amount of benefits that have expired. Prepaid insurance is of great importance to any business, as it ensures that there is no loss in insurance coverage due to missed payments. is prepaid insurance a contra asset Advance payment of insurance enables a business to manage its cash flow and budget since it assures that insurance needs are covered for the prepaid period. Note that in this example we established a short-term and long-term prepaid component because the initial payment was for a two-year subscription. The long-term subscription prepaid represents the value of the subscription paid for in advance beyond 12 months and is amortized at the beginning of the subscription term.

This method makes sure that the expenses match the revenues related to them, following the matching principle in accounting. A business buys one year of general liability insurance in advance, for $12,000. The initial entry is a debit of $12,000 to the prepaid insurance (asset) account, and a credit of $12,000 to the cash (asset) account. In each successive month for the next twelve months, there should be a journal entry that debits the insurance expense account and credits the prepaid expenses (asset) account.